Kalyan Jewellers: A Glimpse into the Share Price Journey

Related Articles: Kalyan Jewellers: A Glimpse into the Share Price Journey

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Kalyan Jewellers: A Glimpse into the Share Price Journey. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Kalyan Jewellers: A Glimpse into the Share Price Journey

Kalyan Jewellers, a prominent name in the Indian jewelry market, has captivated investors with its impressive growth trajectory. The company’s share price, a reflection of its financial performance and market sentiment, has witnessed significant fluctuations over the years. Understanding the factors driving these movements is crucial for investors seeking to make informed decisions.

A Look at the Historical Performance:

Kalyan Jewellers’ share price has experienced a rollercoaster ride since its initial public offering (IPO) in 2017. The IPO itself was met with enthusiasm, with the share price surging above its issue price. However, the subsequent years saw a period of consolidation, with the price remaining relatively stable.

Factors Influencing Share Price Fluctuations:

Several key factors contribute to the volatility of Kalyan Jewellers’ share price:

- Gold Price Movements: As a jewelry retailer, Kalyan Jewellers is heavily reliant on gold prices. A surge in gold prices can negatively impact margins, leading to a decline in share price. Conversely, a fall in gold prices can boost profitability and fuel share price growth.

- Consumer Demand: The demand for jewelry, particularly during festive seasons and weddings, significantly influences Kalyan Jewellers’ sales. Strong consumer demand translates into higher revenue and potentially higher share price. Conversely, weak demand can lead to a decline in share price.

- Competition: The Indian jewelry market is highly competitive, with numerous players vying for market share. Kalyan Jewellers faces competition from both established players and new entrants. Intense competition can impact profitability and, consequently, share price.

- Economic Conditions: The overall economic climate plays a crucial role in consumer spending. During periods of economic uncertainty, consumers may reduce discretionary spending, including jewelry purchases. This can negatively impact Kalyan Jewellers’ sales and share price.

- Financial Performance: Kalyan Jewellers’ financial performance, including revenue growth, profitability, and debt levels, is a key driver of share price. Strong financial performance typically leads to an increase in share price, while weak performance can result in a decline.

- Industry Trends: The jewelry industry is constantly evolving, with new trends and technologies emerging. Kalyan Jewellers’ ability to adapt to these trends and capitalize on emerging opportunities can impact its share price.

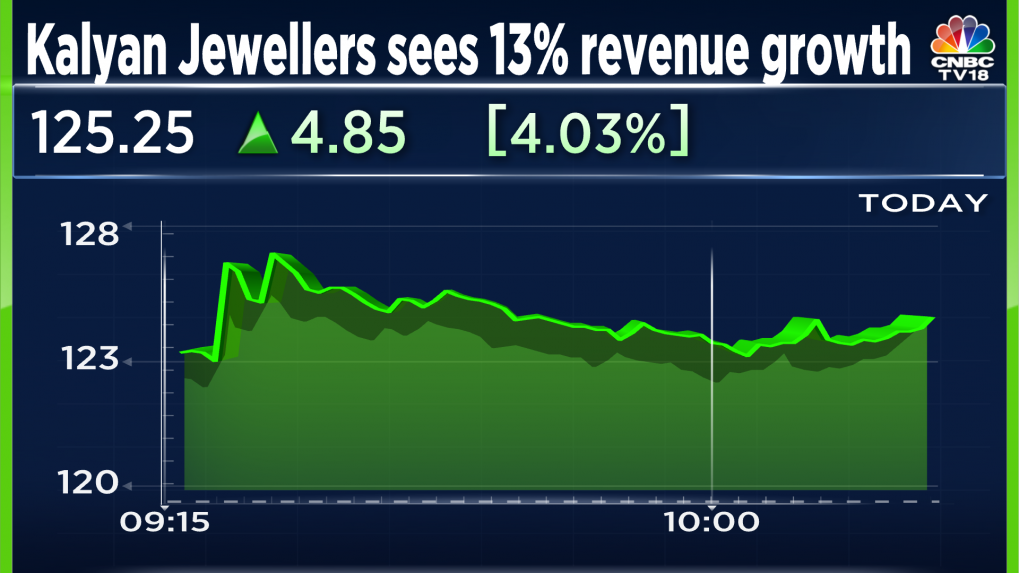

Analyzing Recent Performance:

In recent years, Kalyan Jewellers’ share price has shown resilience, despite facing challenges such as the COVID-19 pandemic and global economic uncertainties. The company has implemented strategies to mitigate these challenges, including expanding its digital presence and focusing on cost optimization.

Key Highlights of Recent Performance:

- Increased Revenue: Kalyan Jewellers has reported consistent revenue growth in recent quarters, driven by strong demand for jewelry, particularly in the festive season.

- Improved Profitability: The company has managed to improve its profitability through cost optimization and operational efficiency.

- Debt Reduction: Kalyan Jewellers has been actively reducing its debt levels, which has strengthened its financial position.

- Expanding Online Presence: The company has invested heavily in its online platform, leveraging the growing trend of online shopping for jewelry.

Looking Ahead:

The future of Kalyan Jewellers’ share price hinges on several factors, including:

- Sustaining Revenue Growth: The company needs to continue generating strong revenue growth to maintain investor confidence.

- Maintaining Profitability: Profitability is crucial for sustained share price growth. Kalyan Jewellers must continue to optimize costs and improve operational efficiency.

- Adapting to Industry Trends: The jewelry industry is evolving rapidly. Kalyan Jewellers must adapt to new trends and technologies to remain competitive.

- Navigating Economic Challenges: The global economy faces several challenges, including inflation and geopolitical tensions. Kalyan Jewellers must navigate these challenges effectively to protect its business and share price.

FAQs Regarding Kalyan Jewellers’ Share Price:

1. What are the key factors to consider before investing in Kalyan Jewellers’ shares?

Investors should carefully consider the factors discussed above, including gold price movements, consumer demand, competition, economic conditions, financial performance, and industry trends.

2. Is Kalyan Jewellers’ share price a good investment for long-term investors?

Whether Kalyan Jewellers’ share price is a good long-term investment depends on individual investor risk tolerance and investment goals. Investors should conduct thorough research and consider the factors discussed above before making any investment decisions.

3. What are the potential risks associated with investing in Kalyan Jewellers’ shares?

Investing in Kalyan Jewellers’ shares carries inherent risks, including volatility in gold prices, fluctuations in consumer demand, intense competition, economic uncertainties, and changes in industry trends.

4. How does Kalyan Jewellers’ share price compare to its peers?

Investors should compare Kalyan Jewellers’ share price performance with its peers in the jewelry sector to gain a better understanding of its relative valuation.

5. Where can I find information about Kalyan Jewellers’ share price?

Information about Kalyan Jewellers’ share price can be found on financial websites such as Yahoo Finance, Google Finance, and Bloomberg.

Tips for Investing in Kalyan Jewellers’ Shares:

- Conduct Thorough Research: Before investing, thoroughly research Kalyan Jewellers’ financial performance, industry trends, and competitive landscape.

- Consider Your Risk Tolerance: Invest only an amount you are comfortable losing.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your portfolio with investments in other sectors.

- Monitor Your Investments: Regularly monitor your investments and adjust your strategy as needed.

- Seek Professional Advice: Consider seeking professional financial advice from a qualified financial advisor.

Conclusion:

Kalyan Jewellers’ share price is a dynamic indicator of the company’s financial performance and market sentiment. Understanding the factors influencing its price movements is crucial for investors seeking to make informed decisions. While the company faces challenges, its recent performance suggests a positive outlook for the future. Investors should carefully consider the risks and rewards associated with investing in Kalyan Jewellers’ shares before making any investment decisions.

Closure

Thus, we hope this article has provided valuable insights into Kalyan Jewellers: A Glimpse into the Share Price Journey. We thank you for taking the time to read this article. See you in our next article!