Navigating the Sparkle: A Comprehensive Guide to K Jewelers Credit Cards

Related Articles: Navigating the Sparkle: A Comprehensive Guide to K Jewelers Credit Cards

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Sparkle: A Comprehensive Guide to K Jewelers Credit Cards. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Sparkle: A Comprehensive Guide to K Jewelers Credit Cards

K Jewelers, a renowned name in the jewelry industry, offers a credit card designed to enhance the customer experience and facilitate the purchase of coveted pieces. This guide delves into the nuances of this card, providing a comprehensive understanding of its features, benefits, and potential drawbacks, empowering individuals to make informed decisions about its suitability.

Understanding the K Jewelers Credit Card:

The K Jewelers credit card is a store credit card, specifically tailored for purchases at K Jewelers stores and online platforms. It functions similarly to other store cards, allowing customers to make purchases and pay them off over time. However, the card’s true value lies in its unique benefits, designed to cater to jewelry enthusiasts and those seeking financing options for their purchases.

Key Features and Benefits:

-

Exclusive Discounts and Rewards: The K Jewelers credit card grants access to exclusive discounts and promotions, often exceeding those available to general customers. These discounts can significantly reduce the cost of jewelry purchases, making it a compelling option for budget-conscious shoppers.

-

Special Financing Options: One of the most attractive features is the availability of special financing options. This allows customers to spread out the cost of their purchases over extended periods, making high-value items more attainable. Flexible payment plans can be tailored to individual financial situations, easing the burden of large purchases.

-

Extended Warranty and Protection: Purchasing jewelry involves a significant investment, and the K Jewelers credit card offers peace of mind through extended warranties and protection plans. These benefits safeguard against accidental damage, theft, or other unforeseen circumstances, ensuring the longevity of the purchased items.

-

Flexible Payment Options: The card provides flexibility in payment options, allowing customers to choose their preferred method, whether it’s a minimum payment or a full balance settlement. This flexibility empowers customers to manage their finances effectively and avoid accruing excessive interest charges.

Considerations and Potential Drawbacks:

While the K Jewelers credit card offers numerous advantages, it’s essential to consider potential drawbacks:

-

High Interest Rates: Like many store credit cards, the K Jewelers card typically carries a higher interest rate compared to general credit cards. It’s crucial to understand the interest rate and ensure the ability to repay the balance promptly to avoid accruing significant interest charges.

-

Limited Usage: The primary purpose of the K Jewelers credit card is for purchases at K Jewelers stores and online platforms. While it can be used for other purchases, the rewards and benefits are primarily applicable to jewelry purchases.

-

Potential for Overspending: The ease of obtaining financing through the card can sometimes lead to overspending. It’s crucial to establish a budget and stick to it, ensuring responsible use and avoiding excessive debt accumulation.

Navigating the Application Process:

Applying for the K Jewelers credit card is a straightforward process, typically involving the following steps:

-

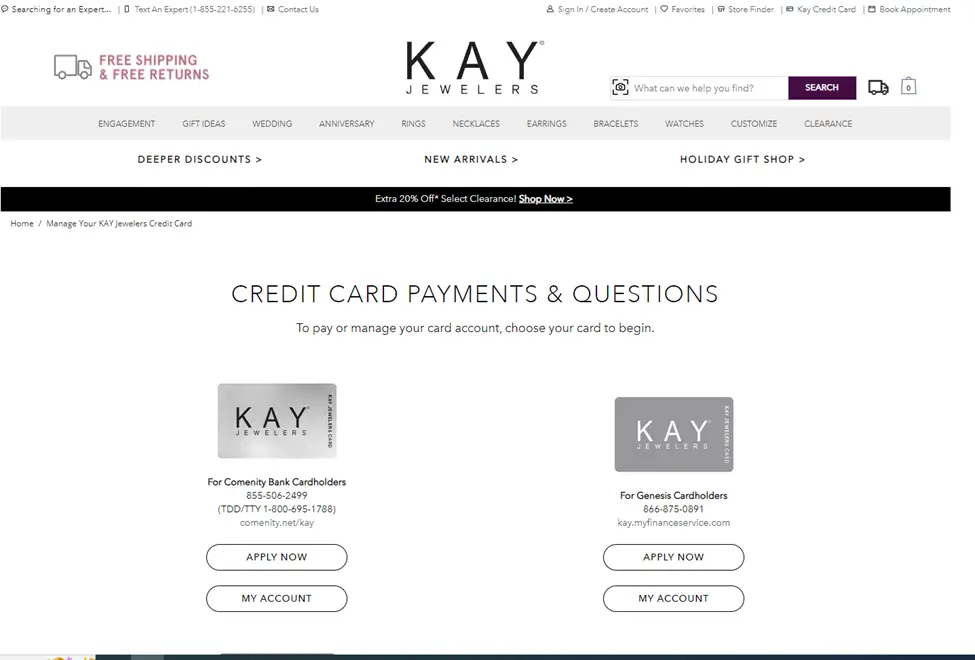

Online Application: The application can be submitted online through the K Jewelers website, providing convenience and accessibility.

-

Credit Check: The application will undergo a credit check to assess creditworthiness and determine eligibility for the card.

-

Approval and Activation: Upon approval, the cardholder will receive a notification and the card will be activated for use.

Frequently Asked Questions (FAQs):

Q1: Who is eligible for the K Jewelers credit card?

A1: Eligibility for the K Jewelers credit card is subject to creditworthiness, assessed through a credit check. Generally, individuals with a good credit history have a higher chance of approval.

Q2: What is the annual fee for the K Jewelers credit card?

A2: The K Jewelers credit card typically does not have an annual fee, making it a cost-effective option for frequent jewelry buyers.

Q3: How can I manage my K Jewelers credit card account?

A3: Account management can be done online through the K Jewelers website, allowing customers to view statements, make payments, and access other account features.

Q4: What are the payment options available for the K Jewelers credit card?

A4: Payment options typically include online payments, phone payments, and mail-in payments, providing flexibility for customers to choose their preferred method.

Q5: Can I use my K Jewelers credit card for purchases outside of K Jewelers?

A5: While the card can be used for purchases outside of K Jewelers, the benefits and rewards are primarily applicable to jewelry purchases.

Tips for Maximizing the K Jewelers Credit Card:

-

Utilize Exclusive Discounts: Take advantage of the exclusive discounts and promotions offered to cardholders, ensuring the best possible value for jewelry purchases.

-

Explore Financing Options: If a large purchase is planned, explore the available financing options to spread out the cost and make the purchase more manageable.

-

Pay on Time: Promptly pay the balance due to avoid accruing high interest charges and maintain a good credit history.

-

Set a Budget: Establish a budget for jewelry purchases and stick to it, preventing overspending and ensuring responsible use of the card.

-

Consider Alternatives: If the high interest rates or limited usage of the card are concerns, consider other credit card options that may better suit your needs.

Conclusion:

The K Jewelers credit card offers a unique blend of benefits for jewelry enthusiasts, including exclusive discounts, financing options, and extended protection plans. However, it’s crucial to understand the potential drawbacks, such as high interest rates and limited usage. By carefully considering the features, benefits, and potential downsides, individuals can make informed decisions about whether the K Jewelers credit card aligns with their financial goals and shopping habits.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Sparkle: A Comprehensive Guide to K Jewelers Credit Cards. We thank you for taking the time to read this article. See you in our next article!