Protecting Your Treasures: A Comprehensive Guide to Lifetime Jewelry Protection Plans

Related Articles: Protecting Your Treasures: A Comprehensive Guide to Lifetime Jewelry Protection Plans

Introduction

With great pleasure, we will explore the intriguing topic related to Protecting Your Treasures: A Comprehensive Guide to Lifetime Jewelry Protection Plans. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Protecting Your Treasures: A Comprehensive Guide to Lifetime Jewelry Protection Plans

Jewelry holds sentimental and financial value, representing cherished memories, milestones, and investments. As such, protecting these valuable pieces is paramount. While traditional insurance policies offer coverage, a lifetime jewelry protection plan provides a comprehensive and enduring safeguard for your precious possessions.

Understanding the Essence of Lifetime Jewelry Protection

A lifetime jewelry protection plan goes beyond basic insurance by offering lifelong coverage against a wide range of risks, including:

- Accidental Damage: From accidental drops to scratches and dents, this plan covers repairs or replacement for damage incurred during everyday wear.

- Theft and Loss: Should your jewelry be stolen or lost, the plan provides compensation for its replacement or repair, offering peace of mind against unforeseen circumstances.

- Wear and Tear: Over time, jewelry can experience natural wear and tear, affecting its appearance and value. This plan covers repairs and maintenance to ensure your pieces remain beautiful and lustrous.

- Cleaning and Inspection: Regular cleaning and inspection are crucial for maintaining the brilliance and longevity of jewelry. These services are often included in lifetime protection plans, ensuring your pieces are handled by experts.

Benefits of Choosing Lifetime Jewelry Protection

Investing in a lifetime jewelry protection plan offers numerous advantages:

- Financial Security: Protection against financial loss due to damage, theft, or loss provides a safety net for your valuable possessions.

- Peace of Mind: Knowing your jewelry is insured against various risks allows you to enjoy your pieces without constant worry.

- Preservation of Value: Regular maintenance and repairs ensure your jewelry retains its aesthetic appeal and market value over time.

- Convenience and Accessibility: Lifetime plans offer a single point of contact for all your jewelry protection needs, simplifying the process of claims and repairs.

- Expert Care: The plan often includes access to certified jewelers and gemologists for repairs, cleaning, and appraisals, ensuring your pieces are handled with the utmost care.

Factors to Consider When Selecting a Plan

Choosing the right lifetime jewelry protection plan requires careful consideration of several factors:

- Coverage Scope: Evaluate the types of risks covered by the plan, ensuring it aligns with your specific needs and the types of jewelry you own.

- Deductibles and Co-pays: Understand the deductible amount and any co-payments associated with claims to ensure financial feasibility.

- Plan Provider: Research the reputation and financial stability of the plan provider to ensure reliable and trustworthy service.

- Policy Terms and Conditions: Thoroughly review the policy terms and conditions, including exclusions, limitations, and claim procedures.

- Cost and Value: Compare the cost of the plan with the value of your jewelry to ensure a cost-effective and worthwhile investment.

FAQs Regarding Lifetime Jewelry Protection Plans

1. What types of jewelry are covered under a lifetime protection plan?

Most lifetime jewelry protection plans cover a wide range of jewelry, including:

- Diamond and gemstone rings, earrings, necklaces, and bracelets

- Watches

- Precious metal jewelry

- Antique and heirloom pieces

However, specific exclusions may apply, such as items with pre-existing damage or those not deemed valuable enough for coverage.

2. How does the claim process work for a lifetime jewelry protection plan?

In case of damage, theft, or loss, you will need to file a claim with the plan provider. This typically involves:

- Reporting the incident

- Providing documentation (e.g., police report for theft)

- Submitting the jewelry for evaluation by a certified jeweler

The plan provider will assess the claim and determine the appropriate course of action, which could include repair, replacement, or compensation.

3. What are the typical exclusions in a lifetime jewelry protection plan?

Common exclusions in lifetime jewelry protection plans include:

- Jewelry used for commercial purposes

- Jewelry worn in hazardous activities (e.g., sports)

- Pre-existing damage or wear and tear

- Loss or damage due to negligence or intentional acts

- Items with a value below a certain threshold

4. How can I find a reputable lifetime jewelry protection plan provider?

To find a reputable provider, consider the following:

- Seek recommendations from trusted sources, such as jewelers, financial advisors, or consumer protection organizations.

- Research online reviews and ratings of different providers.

- Verify the provider’s financial stability and licensing.

- Compare coverage, terms, and pricing across multiple providers.

5. What are the benefits of choosing a lifetime jewelry protection plan over traditional insurance?

Lifetime plans offer several advantages over traditional insurance:

- Lifelong coverage: Provides continuous protection for your jewelry, unlike temporary insurance policies.

- Comprehensive protection: Often covers a broader range of risks, including wear and tear.

- Convenience and accessibility: Simplifies the claim process and offers dedicated support.

- Expert care: Provides access to certified jewelers for repairs and appraisals.

Tips for Maximizing the Benefits of Lifetime Jewelry Protection

- Thorough Documentation: Keep detailed records of your jewelry, including purchase receipts, appraisals, and photographs.

- Regular Maintenance: Schedule regular cleaning and inspection appointments with a certified jeweler to prevent damage and maintain the value of your jewelry.

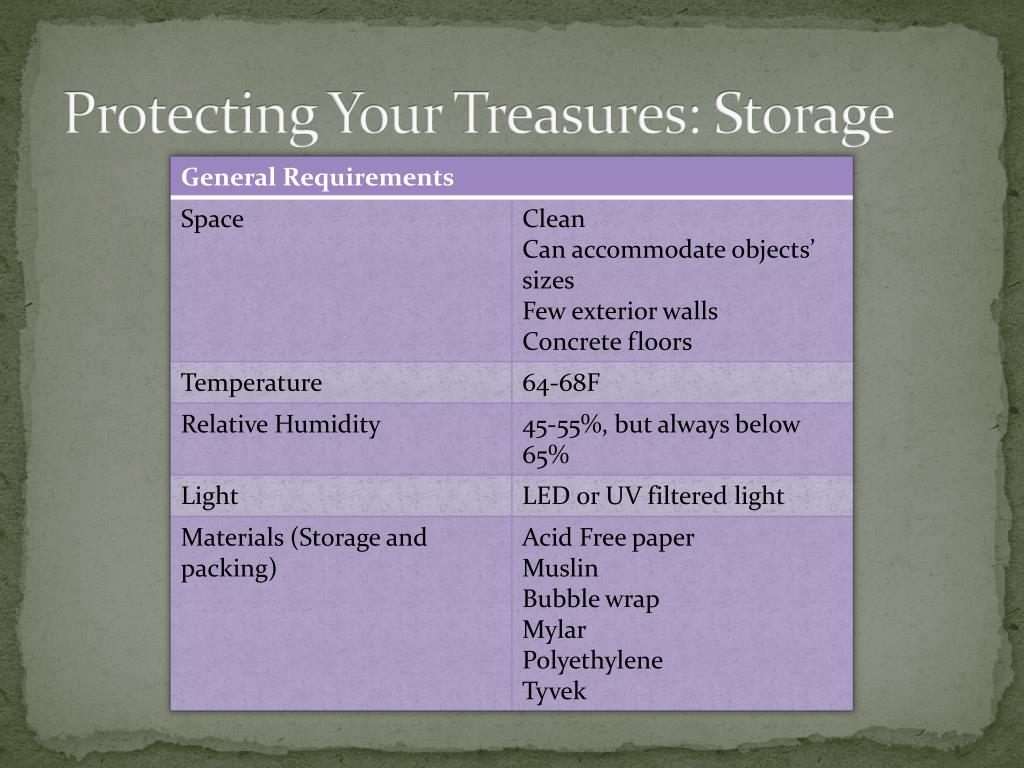

- Safe Storage: Store your jewelry in a secure location when not wearing it, such as a safe deposit box or a secure jewelry box with a lock.

- Proper Wear and Care: Follow the recommended care instructions for your jewelry to prevent damage and extend its lifespan.

- Stay Informed: Review your policy terms and conditions periodically to ensure you understand the coverage and any changes.

Conclusion

Lifetime jewelry protection plans offer an invaluable investment for safeguarding your cherished possessions. By providing lifelong coverage against a wide range of risks, these plans offer peace of mind, financial security, and expert care for your jewelry. By carefully evaluating the plan options, understanding the terms and conditions, and following best practices, you can ensure your jewelry is protected for generations to come. Remember, investing in a lifetime jewelry protection plan is not just about protecting your finances; it’s about preserving the memories and sentimental value associated with your treasured pieces.

.png)

Closure

Thus, we hope this article has provided valuable insights into Protecting Your Treasures: A Comprehensive Guide to Lifetime Jewelry Protection Plans. We appreciate your attention to our article. See you in our next article!