Securing the Sparkle: A Guide to Loans for Jewelry Businesses

Related Articles: Securing the Sparkle: A Guide to Loans for Jewelry Businesses

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Securing the Sparkle: A Guide to Loans for Jewelry Businesses. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Securing the Sparkle: A Guide to Loans for Jewelry Businesses

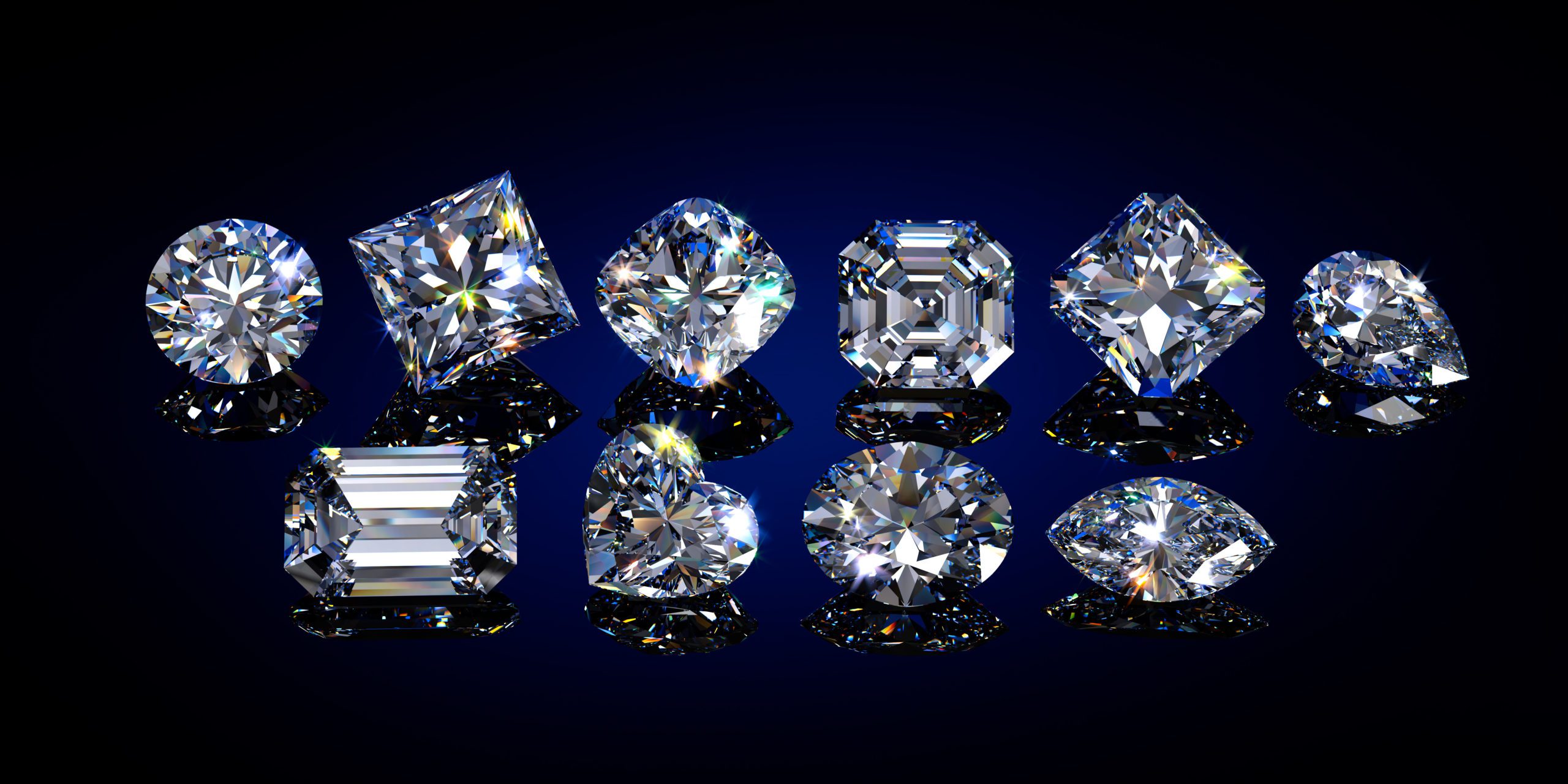

The world of jewelry is captivating, a realm of shimmering stones, intricate designs, and timeless elegance. However, establishing and maintaining a successful jewelry business requires a substantial investment, often exceeding the resources of even the most passionate entrepreneur. This is where the strategic utilization of loans comes into play, offering a vital financial lifeline to propel jewelry businesses towards success.

Understanding the Power of Loans for Jewelry Businesses

Loans for jewelry businesses serve as a potent catalyst for growth, enabling entrepreneurs to acquire the necessary resources to:

- Establish a Solid Foundation: Initial capital is crucial for securing a prime location, equipping the store with display cases, security systems, and inventory. Loans provide the financial bedrock upon which the business can be built.

- Expand and Diversify Inventory: Attracting and retaining customers necessitates a diverse and enticing selection of jewelry pieces. Loans empower businesses to expand their inventory, catering to a broader range of tastes and preferences.

- Invest in Marketing and Branding: Standing out in a competitive market requires effective marketing strategies. Loans can be utilized to implement targeted advertising campaigns, build a strong online presence, and enhance brand recognition.

- Navigate Seasonal Fluctuations: The jewelry industry often experiences seasonal peaks and dips in demand. Loans offer financial stability to bridge these periods, ensuring smooth operations and consistent customer service.

- Embrace Technological Advancements: The jewelry industry is constantly evolving, with new technologies emerging for design, production, and sales. Loans enable businesses to adopt these advancements, enhancing efficiency and staying ahead of the curve.

Types of Loans for Jewelry Businesses

The landscape of loan options for jewelry businesses is diverse, offering tailored solutions to meet specific needs:

- Small Business Loans: These are general-purpose loans offered by banks and non-bank lenders, providing flexible funding for various business expenses.

- Equipment Loans: Specifically designed for purchasing essential equipment, such as display cases, security systems, and jewelry-making tools.

- Inventory Financing: Enables businesses to acquire inventory on credit, allowing for a larger selection and better pricing flexibility.

- Line of Credit: Provides a revolving credit line that can be accessed as needed, offering flexibility and convenience for managing cash flow.

- SBA Loans: Backed by the Small Business Administration, these loans offer favorable terms and lower interest rates for eligible businesses.

Factors to Consider When Seeking a Loan

Before embarking on the loan application process, it is essential to carefully consider the following factors:

- Credit Score: A strong credit score is crucial for securing favorable loan terms, as lenders assess your financial reliability.

- Business Plan: A well-structured business plan outlining your financial projections, marketing strategies, and growth plans is essential for convincing lenders of your business’s viability.

- Collateral: Lenders may require collateral, such as property or inventory, to secure the loan, reducing their risk.

- Loan Terms: Compare interest rates, repayment periods, and fees across different lenders to identify the most advantageous terms.

Tips for a Successful Loan Application

- Prepare a Detailed Financial Statement: Provide accurate and comprehensive financial information, including income statements, balance sheets, and cash flow statements.

- Highlight Your Business’s Strengths: Emphasize your unique selling proposition, experienced team, strong customer base, and potential for growth.

- Address Potential Challenges: Acknowledge any financial challenges or risks, but also present mitigating strategies and plans to overcome them.

- Maintain Open Communication: Be responsive to lender inquiries, providing timely and complete documentation.

FAQs about Loans for Jewelry Businesses

Q: What is the typical interest rate for jewelry business loans?

A: Interest rates vary depending on factors such as your credit score, loan amount, and loan type. However, expect interest rates to range from 5% to 15%.

Q: How long is the typical repayment period for jewelry business loans?

A: Repayment periods can range from 1 to 10 years, depending on the loan type and lender.

Q: What are the common fees associated with jewelry business loans?

A: Common fees include origination fees, closing costs, and annual fees.

Q: What are the eligibility requirements for a jewelry business loan?

A: Eligibility requirements vary by lender, but generally include a strong credit score, a viable business plan, and sufficient collateral.

Q: How can I improve my chances of getting a loan approved?

A: Maintain a good credit score, develop a robust business plan, secure collateral, and demonstrate a solid track record of financial management.

Conclusion

Loans for jewelry businesses are an invaluable tool for achieving growth, expansion, and financial stability. By carefully considering the various loan options, understanding the key factors involved, and following these tips, jewelry entrepreneurs can secure the necessary funding to realize their business aspirations and create a lasting legacy of brilliance. Remember, a well-structured loan can be the key to unlocking the full potential of your jewelry business, allowing you to shine bright in the competitive landscape of this captivating industry.

Closure

Thus, we hope this article has provided valuable insights into Securing the Sparkle: A Guide to Loans for Jewelry Businesses. We hope you find this article informative and beneficial. See you in our next article!