Understanding the Intricacies of Loan Interest Rates Against Gold Bonds

Related Articles: Understanding the Intricacies of Loan Interest Rates Against Gold Bonds

Introduction

With great pleasure, we will explore the intriguing topic related to Understanding the Intricacies of Loan Interest Rates Against Gold Bonds. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Understanding the Intricacies of Loan Interest Rates Against Gold Bonds

- 2 Introduction

- 3 Understanding the Intricacies of Loan Interest Rates Against Gold Bonds

- 3.1 What is a Loan Against Gold Bonds?

- 3.2 Factors Influencing Loan Interest Rates Against Gold Bonds

- 3.3 Benefits of Loans Against Gold Bonds

- 3.4 Understanding Interest Rate Calculation and Impact

- 3.5 Importance of Comparing Interest Rates

- 3.6 Tips for Securing a Favorable Interest Rate

- 3.7 FAQs on Loan Against Gold Bonds Interest Rates

- 3.8 Conclusion

- 4 Closure

Understanding the Intricacies of Loan Interest Rates Against Gold Bonds

In today’s financial landscape, individuals and businesses often seek alternative financing options to bridge temporary financial gaps. One such option, gaining increasing popularity, is a loan against gold bonds. This article delves into the intricacies of interest rates associated with such loans, providing a comprehensive understanding of their impact on borrowers.

What is a Loan Against Gold Bonds?

A loan against gold bonds allows individuals to leverage the value of their gold bonds as collateral to secure a loan. This type of loan provides access to immediate cash while retaining ownership of the gold bonds. The interest rate applied to these loans is a crucial factor influencing the overall cost of borrowing.

Factors Influencing Loan Interest Rates Against Gold Bonds

Several factors determine the interest rate on a loan against gold bonds. Understanding these factors is essential for borrowers to make informed decisions and secure the most favorable terms:

1. The Lender’s Risk Assessment:

Lenders assess the inherent risk associated with lending against gold bonds. Factors considered include:

- Purity and Value of the Gold Bonds: The purity and current market value of the gold bonds directly impact the loan amount and interest rate. Higher purity and value typically translate to lower interest rates.

- Borrower’s Creditworthiness: The lender evaluates the borrower’s credit history, income stability, and repayment capacity. A strong credit score and stable financial standing often lead to lower interest rates.

- Loan-to-Value (LTV) Ratio: The LTV ratio, which is the percentage of the gold bond’s value that the lender is willing to lend, influences the interest rate. Lower LTV ratios typically result in lower interest rates.

2. Market Interest Rates:

General prevailing interest rates in the financial market significantly influence loan interest rates against gold bonds. When market interest rates rise, lenders tend to increase their interest rates to maintain profitability.

3. Loan Tenure:

The duration of the loan, or the loan tenure, impacts the interest rate. Longer loan terms generally involve higher interest rates to compensate for the lender’s exposure to risk over an extended period.

4. Loan Amount:

Larger loan amounts often attract higher interest rates due to the increased risk for the lender. Conversely, smaller loan amounts may come with lower interest rates.

5. Collateral Valuation and Insurance:

The lender may charge a fee for valuing the gold bonds as collateral and for insurance coverage to protect against loss or damage. These fees can indirectly influence the overall interest rate.

Benefits of Loans Against Gold Bonds

Loans against gold bonds offer several advantages over traditional loans:

- Faster Approval and Disbursement: The process for securing a loan against gold bonds is often faster than traditional loans, as the collateral is readily verifiable.

- Lower Interest Rates: Compared to personal loans or credit card debt, interest rates on loans against gold bonds can be significantly lower.

- No Income Proof Required: Many lenders do not require income proof for loans against gold bonds, making it accessible to individuals with varying income levels.

- Flexibility: Borrowers can choose to repay the loan in installments or in a lump sum, offering flexibility in repayment options.

- Preservation of Ownership: Borrowers retain ownership of their gold bonds throughout the loan tenure, providing a sense of security.

Understanding Interest Rate Calculation and Impact

Interest rates on loans against gold bonds are typically expressed as an annual percentage rate (APR). The APR includes the base interest rate plus any applicable fees. The interest rate is applied to the outstanding loan amount, and the borrower is responsible for paying the interest accrued over the loan tenure.

The interest rate significantly influences the overall cost of borrowing. A higher interest rate leads to higher interest payments over the loan term, increasing the total cost of the loan. Conversely, a lower interest rate results in lower interest payments, making the loan more affordable.

Importance of Comparing Interest Rates

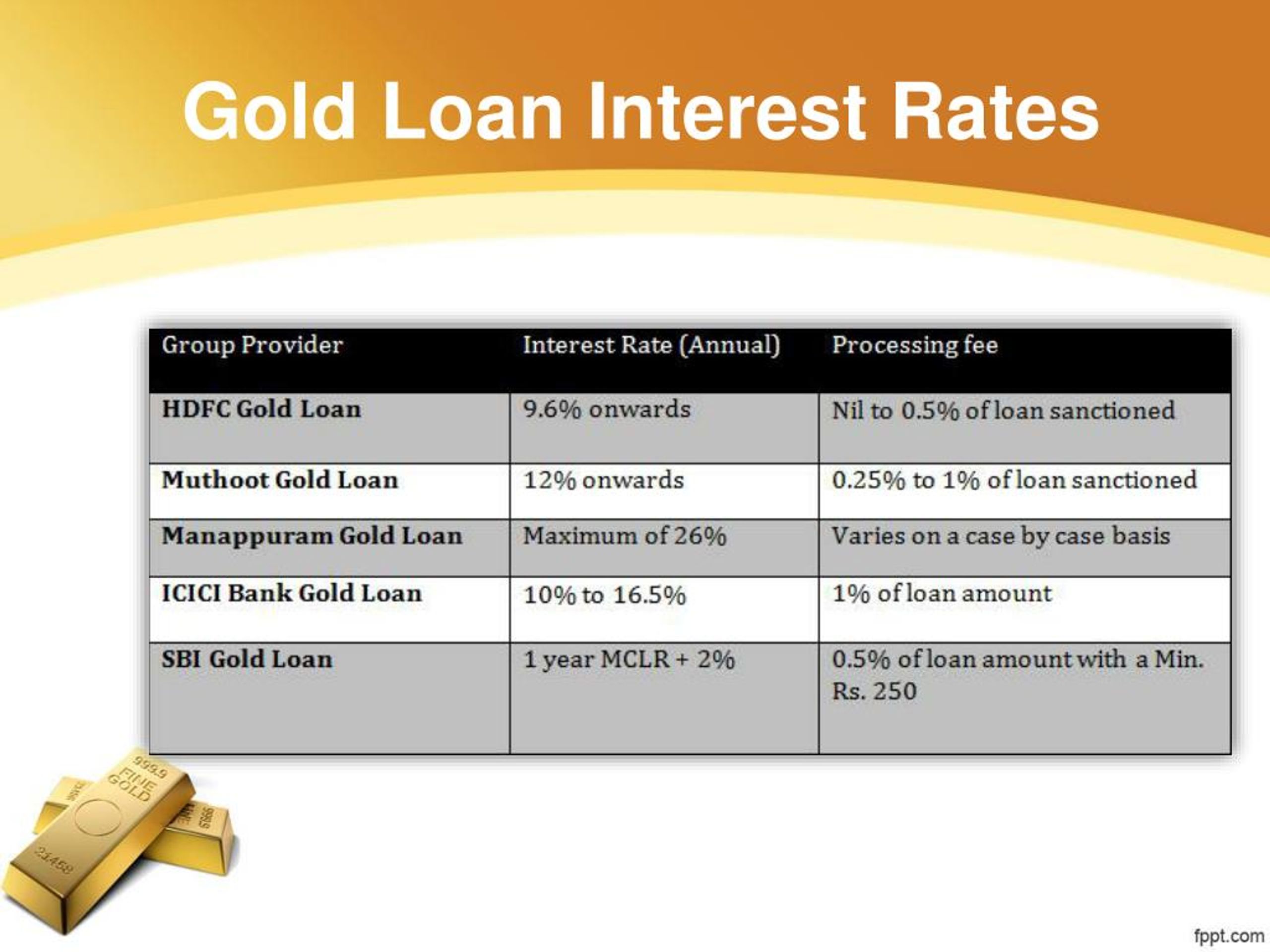

Before securing a loan against gold bonds, it is crucial to compare interest rates offered by different lenders. Comparing interest rates allows borrowers to identify the most favorable terms and minimize the overall cost of borrowing.

Tips for Securing a Favorable Interest Rate

- Maintain a Good Credit Score: A strong credit score demonstrates financial responsibility and can lead to lower interest rates.

- Shop Around for Lenders: Compare interest rates from multiple lenders to identify the most competitive offers.

- Negotiate the Interest Rate: Do not hesitate to negotiate with lenders to secure a lower interest rate, especially if you have a strong credit history or are borrowing a significant amount.

- Consider the Loan Tenure: Choose a loan tenure that aligns with your repayment capacity. Shorter loan terms generally result in lower interest rates.

- Minimize Additional Fees: Inquire about any additional fees associated with the loan, such as valuation fees or insurance premiums, as these can indirectly impact the overall interest rate.

FAQs on Loan Against Gold Bonds Interest Rates

1. What is the average interest rate on a loan against gold bonds?

The average interest rate on a loan against gold bonds varies depending on factors such as the lender, loan amount, loan tenure, and borrower’s creditworthiness. However, interest rates typically range from 8% to 15% per annum.

2. How are interest rates calculated on loans against gold bonds?

Interest rates on loans against gold bonds are usually calculated based on a simple interest method, where interest is calculated on the outstanding loan amount. The interest rate is applied to the outstanding loan amount, and the borrower is responsible for paying the interest accrued over the loan tenure.

3. Are there any hidden charges or fees associated with loans against gold bonds?

While some lenders may offer loans with no hidden charges, others may charge fees such as processing fees, valuation fees, insurance premiums, or prepayment penalties. It is essential to inquire about all fees and charges before securing a loan.

4. Can I prepay my loan against gold bonds?

Most lenders allow prepayment of loans against gold bonds, but some may charge prepayment penalties. It is advisable to check the loan agreement for prepayment terms and penalties.

5. What happens if I fail to repay my loan against gold bonds?

If a borrower fails to repay the loan as per the agreed terms, the lender has the right to seize the gold bonds pledged as collateral to recover the outstanding loan amount.

Conclusion

Loans against gold bonds offer a viable financing option for individuals seeking immediate access to cash while retaining ownership of their gold bonds. Understanding the factors influencing interest rates, comparing offers from different lenders, and negotiating favorable terms are crucial steps in securing a loan that meets individual needs and financial objectives. By carefully considering these factors, borrowers can leverage the benefits of loans against gold bonds while minimizing the overall cost of borrowing.

![]()

Closure

Thus, we hope this article has provided valuable insights into Understanding the Intricacies of Loan Interest Rates Against Gold Bonds. We appreciate your attention to our article. See you in our next article!